David Ellison’s heated battle with Netflix for ownership of Warner Bros. Discovery could wind up playing out prominently in Brussels, where regulatory officials are expected to formally open an antitrust probe as part of their approval procedure, once a deal with one of the two contenders is sealed in the U.S.

But even before a Warner Bros. Discovery deal is clinched stateside, so-called “pre-notification discussions” reviewing the rival merger scenarios are already underway within the European Union’s regulatory offices.

So where do Netflix and Paramount stand with Brussels?

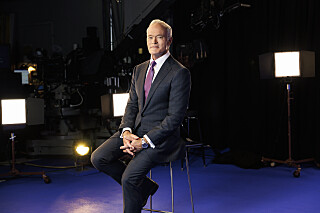

Ellison, who is a man on a mission, made his case for Paramount Skydance with members of the EU’s Directorate-General for Competition as part of a recent European lobbying tour-de-force that also took him to France, where he met with French President Emmanuel Macron, and to Germany and the U.K.

Following that European tour, Ellison sent an open letter earlier this month to journalists around the world — including in the U.K. and France — vowing that if Paramount Skydance clinches the Warner Bros. Discovery deal, that combined entity would produce at least 30 feature films per year which, he underlined, would all be released in movie theatres.

In the missive, which was published as a paid announcement in newspapers around the world, Ellison argued that audiences “are best served by greater choice — not less — and by a marketplace that encourages the full spectrum of filmmaking, content creation, and theatrical exhibition.” He claimed that a Netflix merger would instead eliminate “meaningful competition by creating a monopolistic or dominant entity.”

Netflix, meanwhile, is also believed to be discussing the ins and outs of a Warner Bros. Discovery merger with the EU regulator. And it’s an entity that the U.S. streaming giant knows well.

Netflix has “a well-oiled machine when it comes to lobbying in Europe,” says François Godard, an analyst at Enders Analysis. The company has a longstanding dialogue with Brussels, he notes, having engaged in lots of back and forth over the EU’s Audiovisual Media Services Directive (AVMS) norm that forces foreign streamers to invest a portion of their revenue into local productions. A norm that, by and large, Netflix abides by.

But at this stage, it can be argued that Paramount has an image advantage.

Max von Thun, director of Europe at the Brussels-based Open Markets Institute, says he cannot rule out the possibility that a Netflix deal could clear regulatory hurdles in U.S. and then hit a wall in Europe, where the key regulatory issues will be the acquisition’s effect on European consumers as well as jobs in the production and theatrical exhibition businesses.

According to Von Thun, Paramount Skydance is somewhat at an advantage with the European regulator because the Netflix-Warner Bros. merger would have “a more clear impact on consumers,” he says, since “Netflix are obviously a bigger player in streaming than Paramount are.”

The EU is very sensitive on the issue of consumer prices. There are concerns that if Netflix decided to merge Netflix and HBO Max – which Netflix execs have said they will not do, at least initially — that would give them more leverage to hike subscription costs. Combining Netflix and HBO would also give a merged Netflix-WB more leverage in negotiations with European indie producers and content providers.

According to Godard, just as in the U.S., the main concern in Europe over Netflix clinching the Warner Bros. Discovery deal revolves around the fear that Netflix’s victory could harm the theatrical business.

That’s a concern “which obviously Paramount is in a better position to defend,” he says.

But at the same time, Godard also thinks Netflix “could give very strong reassurances to European regulators that they don’t want to kill movie theatre releases.”

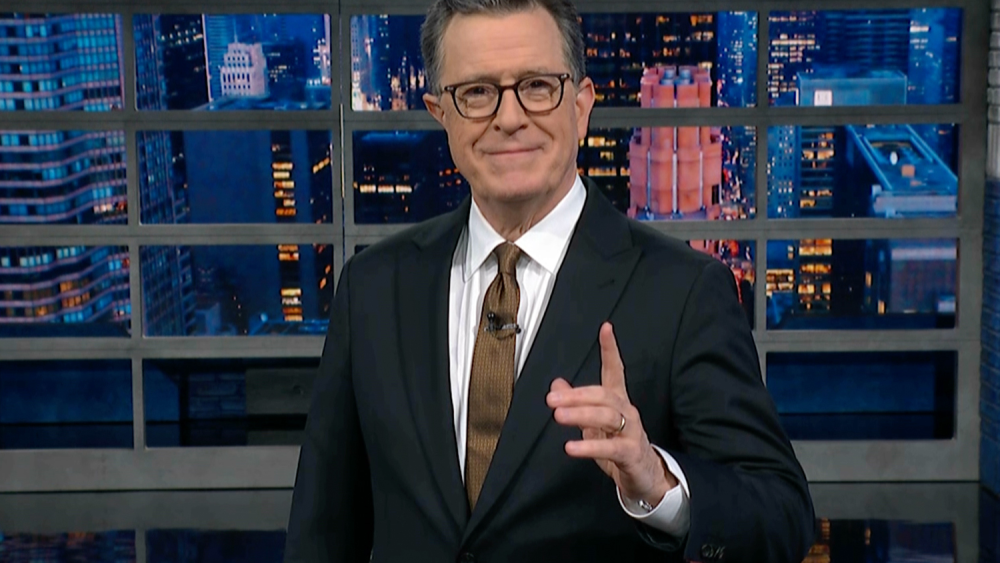

In mid-December, Netflix co-CEO Ted Sarandos met with Macron and French film bosses while he was in France for the premiere of “Emily in Paris” Season 4. He vowed to keep Warner Bros. movies in theaters during a fireside chat with Canal+ Group CEO Maxime Saada. “Our intention is to continue to release Warner movies theatrically, respecting traditional theatrical windows, and we will continue to operate Warner studios independently,” Sarandos said.

“Netflix is after IP in this deal,” according to Godard. “I think they understand that the theatrical window still creates enormous long-term IP value; much more than TV or streaming,” he notes, citing the fact that the value of the “Harry Potter” and “Star Wars” franchises was created by theatrical play.

The International Union of Cinemas (UNIC), which represents film trade associations and theater operators in 39 countries across Europe, also recently met with the EU’s Directorate-General for Competition. After the meeting, they underlined in a statement that theatrical release windows are a “key principle” that has to be protected in any deal. But UNIC added that it does not support either of the current bids, noting that both mergers could result in a “significant downside for European cinema.”

German producer Martin Moskowicz, former head of Constantin, which makes the “Resident Evil” franchise, agrees. “Neither of these deals are good for business,” he says.

But on the EU regulatory side, Moskowicz thinks Netflix has a slight advantage over Paramount.

Netflix’s “antitrust exposure” is lower, he says, since it is already “deeply embedded in local production” in Europe where the company has “a lot more consumer and industry relationships” than Paramount has.

“The one thing the EU will look into is [theatrical] windowing,” notes Moskowicz who, like Godard, believes Netflix will be able to make a convincing case that the streaming giant does not pose an ulterior threat to Europe’s withering moviegoing ecosystem.

Moskowicz and Godard both note that Brussels could ask whichever contender emerges as victor for assurances on specific points, or impose some conditions before the EU gives their deal the greenlight.

But as Von Thun, Godard and other analysts have pointed out, EU regulators very rarely block media mergers. It did not happen with Disney-21st Century Fox in 2018, with Comcast’s bid for Sky the same year or with the 2021 merger of AT&T’s WarnerMedia and Discovery Communications.

So the biggest impact the EU could have on either Warner Bros. Discovery merger deal “could be delay,” says international lawyer Joseph Gulino, managing partner at DRRT. “In the U.S., I think we’ll see a quicker move to approve any deal that is favored by the DOJ and the White House,” Gulino points out.

Ultimately, in Europe, giving the green light will be up to the EU’s antitrust chief, Teresa Ribeira, who has been slapping hefty fines lately on Google and Elon Musk’s X for breaching European Union rules.

But while merger reviews are legally independent from each other in different jurisdictions around the world, don’t forget the bigger political picture.

In practice, “even if the regulators in Europe would say that they are not influenced by what happens in the U.S. obviously, they do take that into account,” says Von Thun.

In the end, U.S. President Donald Trump’s blessing for either deal may be as crucial to winning this battle in Europe as some consider it to be stateside.

“We are in a very fraught geopolitical moment,” Von Thun says. “So I’m sure they [European regulators] will be thinking: ‘Oh, if we block this and Trump approves it, are we going to get some kind of backlash?’”

Leave a Reply